The concept of product vs period costs is a subset of cost accounting. Read our article about managerial accounting to learn more about how it can help your business manage costs. In summary, proper classification of costs as either product or period expenses is vital for financial reporting accuracy and strategic business management. Companies that develop strong costing systems and discipline around classifications put themselves in a superior competitive position.

Fixed and Variable Costs in Product Pricing

This relief is typically provided by the landlord as an incentive or concession to the tenant. During the rent abatement period, the tenant is not required to make regular rent payments. However, if these costs become excessive they can add significantly to total expenses and they should be monitored closely so managers can take action to reduce them when possible. Product expenses are part of the cost of producing or acquiring an asset. During the fourth quarter of 2016, Company XYZ expected to pay $150,000 in rent and utilities and $100,000 in insurance and property taxes.

Our Services

Rent expense is the cost incurred by a business to utilize a property or location for an office, retail space, factory, or storage space. Rent expense is a type of fixed operating cost or an absorption cost for a business, as opposed to a variable expense. Rental expenses are is rent a period cost often subject to a one- or two-year contract between the lessor and lessee, with options to renew. What a company expects to pay during a particular accounting period is included in an expense account while what it pays during the period goes into a prepaid expense account.

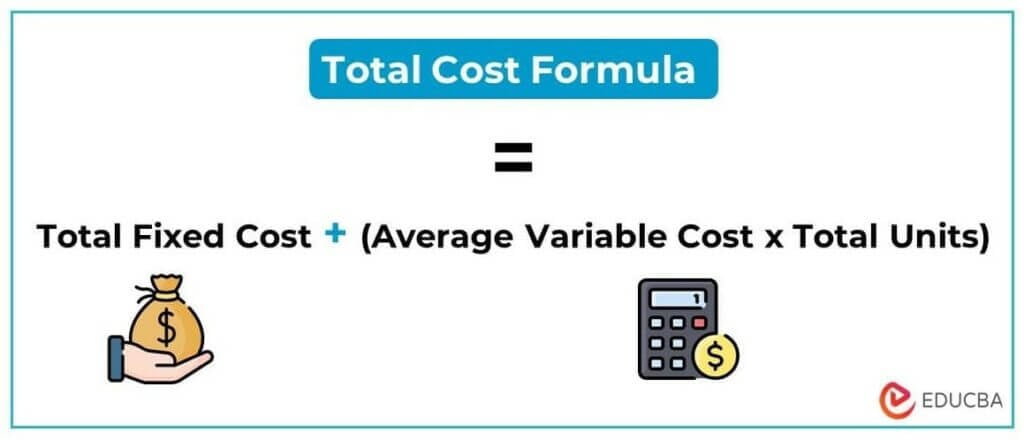

Period cost vs product: calculation of product and period costs

However, since prime costs do not include overhead costs, they are not good for calculating prices that will ensure long-term profitability. Period costs and product costs are important concepts in managerial accounting that help businesses track their expenses. Knowing the key differences between these types of costs can have a big impact on financial reporting and decision making. Grasping the difference between product and period costs serves as a financial compass for businesses. It’s like having a roadmap that guides accurate financial reporting, ensuring that the numbers on the balance sheet and income statement tell a clear and truthful story about the business’s health. Moreover, this understanding empowers businesses to manage costs effectively, making informed decisions about product pricing, production efficiency, and overall operational strategies.

The average rent in Gatineau, Que. is $2,039 a month, including $1,753 for a one-bedroom apartment and $2,248 for a two bedroom. The increase in the popularity of e-commerce has led many companies to rethink the amount of money they spend on renting commercial real estate. Some companies are reducing the number of brick-and-mortar stores they operate to shift more of their operations to online shopping. “Click and mortar” describes a business model in which retailers combine online and offline operations in the form of a website and physical stores to meet consumer demand. This means that a tenant may not be forced to continue to pay rent for specific events that were out of the control of the lessor or lessee. Finance Strategists has an advertising relationship with some of the companies included on this website.

- As part of Starbucks’ annual report, the company acknowledged it received $27.6 million of rent concessions for stores temporarily closed due to the pandemic.

- Rent expense abatement, also known as free rent, is a temporary period where a tenant is granted relief from paying rent for a specific duration.

- To summarize, product costs are inventoried and then recognized as expense upon sale of the product.

- This means that a tenant may not be forced to continue to pay rent for specific events that were out of the control of the lessor or lessee.

- They are the costs that are directly and indirectly related to producing an item.

- Now that we have taken a bird’s eye view of the matching principal, let’s look into the meanings of and difference between product costs and period costs.

Period costs relate to operating the business during an accounting period and are directly expensed on the income statement. Understanding how costs flow through the financial statements is an essential concept in managerial accounting and cost analysis. In summary, period costs like rent and advertising are expensed immediately each accounting period on the income statement. Product costs like materials are included in inventory valuation through cost of goods sold when production occurs. Overhead or sales, general, and administrative (SG&A) costs are considered period costs.

These costs should be monitored closely so managers can find ways to reduce the amount paid when possible. Accounting for both types of expenses is key for profitable pricing strategies. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Executive salaries, clerical salaries, office expenses, office rent, donations, research and development costs, and legal costs are administrative costs. In addition to categorizing costs as manufacturing and nonmanufacturing, they can also be categorized as either product costs or period costs. This classification relates to the matching principle of financial accounting. Therefore, before talking about how a product cost differs from a period cost, we need to look at what the matching principle says about the recognition of costs. Ending inventory is like a treasure trove of products waiting to leave the shelves and go to customers.

These costs include the costs of direct materials, direct labor, and manufacturing overhead. They will not be expensed until the finished good are sold and appear on the income statement as cost of goods sold. Period costs are closely related to periods of time rather than units of products. For this reason, businesses expense period costs in the period in which they are incurred. Accountants treat all selling and administrative expenses as period costs for external financial reporting.

Starbucks also notes in its annual report that its leases “often include options to extend or terminate at our sole discretion.” In a triple-net lease, the tenant assumes responsibility for paying not only the base rent but also all or a portion of the property’s operating expenses. These expenses may include property taxes, property insurance, and common area maintenance charges. Examples of period expenses include vendor bills, storage for supplies or inventory not generating revenue, borrowing money to cover current costs, etc.