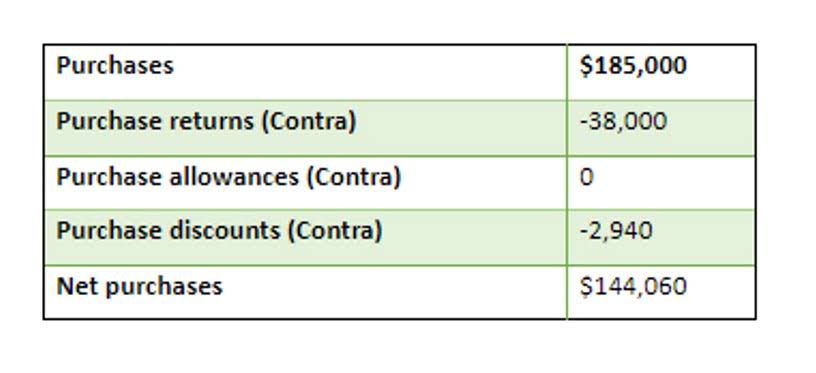

The cost of this sale will be the cost of the 10 units of inventory sold which is $250 (10 units x $25). The difference https://www.facebook.com/BooksTimeInc/ between the $400 income and $250 cost of sales represents a profit of $150. The inventory (asset) will decrease by $250 and a cost of sale (expense) will be recorded.

Basic Accounting Equation Formula

A higher percentage means more of your assets are financed through debt, which could be problematic. The company is at higher risk of bankruptcy or insolvency (unable to pay its debts), according to The Balance. The above section demonstrates how to use this formula to find total assets. A liability is what a business owes, such as business loans, taxes owing or operating expenses. It’s generally simpler and more accurate to use accounting software to generate a balance sheet.

What is Balance Sheet Formula?

Accountingo.org aims to provide the best accounting and finance education for students, professionals, teachers, and business owners. Since only one month would have passed by 31 December out of the three-month period covered by the advance, two months’ rent will be recognized as a prepaid asset in the balance sheet. Lou paid a 3-month advance amounting to $3000 for a small painting studio that she rented on 1 December 2020. The term of the rental agreement is 2 years but the owner can request Lou to vacate the property at anytime by serving a notice.

Assets = Liabilities + Equity

This is achieved through LiveCube, a ‘No Code’ platform, that replaces assets formula accounting Excel and automates data fetching, modeling, analysis, and journal entry proposals. Drawings are amounts taken out of the business by the business owner. A potential lender will also want to know the value of a business’s assets as they can be used as leverage (a guarantee) to get a new loan, according to the Houston Chronicle. Think of retained earnings as savings, since it represents the total profits that have been saved and put aside (or “retained”) for future use. Debt is a liability, whether it is a long-term loan or a bill that is due to be paid.

- In this sense, the liabilities are considered more current than the equity.

- Since Speakers, Inc. doesn’t have $500,000 in cash to pay for a building, it must take out a loan.

- If assets increase, either liabilities or owner’s equity must increase to balance out the equation.

- Thus, the above total assets equation show the different categories of assets that come under the head of total assets in the balance sheet.

- Receivables arise when a company provides a service or sells a product to someone on credit.

Due within the year, current liabilities on a balance sheet include accounts payable, wages or payroll payable and taxes payable. Long-term liabilities are usually owed to lending institutions and include notes payable and possibly unearned revenue. Like any mathematical equation, the accounting equation can be rearranged and expressed in terms of liabilities or owner’s equity instead of assets. We calculate the expanded accounting equation using 2021 financial statements for this example.

For the past 52 years, Harold Averkamp (CPA, MBA) https://www.bookstime.com/ has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. If the equation doesn’t work, you need to double check your figures. Otherwise, you will need to manually add up your assets if you’re using a template in, say, Excel. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

- For example, a borrower receives cash as part of a loan, which is a current asset; nevertheless, the loan amount is also included as a liability on the balance sheet.

- 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

- The income statement reports the revenues, gains, expenses, losses, net income and other totals for the period of time shown in the heading of the statement.

- So whatever the worth of assets and liabilities of a business are, the owners’ equity will always be the remaining amount (total assets MINUS total liabilities) that keeps the accounting equation in balance.

- Previously, there have been several instances where the assets were misrepresented, and financial statements were window dressed to obtain funding for financial institutions.

- This is how the accounting equation of Laura’s business looks like after incorporating the effects of all transactions at the end of month 1.

Income and expenses relate to the entity’s financial performance. Individual transactions which result in income and expenses being recorded will ultimately result in a profit or loss for the period. The term capital includes the capital introduced by the business owner plus or minus any profits or losses made by the business.

Assets are defined as resources owned by the company from which future economic benefits are expected to be generated. Total assets are the sum of non-current and current assets, and this total should equal the sum of stockholders’ equity and total liabilities combined. If the left side of the accounting equation (total assets) increases or decreases, the right side (liabilities and equity) also changes in the same direction to balance the equation. The accounting equation equates a company’s assets to its liabilities and equity.